Paycheckcity calculator hourly

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Hourly Billing Invoice Template

This Idaho hourly paycheck calculator is perfect for those who are paid on an hourly basis.

. This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Our Hourly Paycheck Calculator is designed to provide general guidance and estimates. Switch to Nevada salary calculator.

This Alabama hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Minnesota salary calculator. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This Nebraska hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The PaycheckCity salary calculator will do the calculating for you. Dont want to calculate this by hand. Switch to Missouri salary calculator.

HOURLY PAYCHECK CALCULATOR - Disclaimer. It should not be relied upon to calculate exact payroll or other financial data. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Switch to salary calculator. Subtract any deductions and payroll taxes from the gross pay to get net pay. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator.

The Washington bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Alabama salary calculator.

Switch to Nevada hourly calculator. Switch to Wisconsin salary calculator. Switch to North Carolina hourly calculator.

This Minnesota hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Switch to Michigan salary calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This number is the gross pay per pay period. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Switch to Iowa hourly calculator. Switch to Kansas salary calculator. This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. We make no claims as to the accuracy completeness and timeliness by any of our hourly wage calculator. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator.

This Nevada hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator.

Switch to Texas hourly calculator. Calculate your Nevada net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nevada paycheck calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. This Kansas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Switch to Nebraska salary calculator. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Switch to Missouri hourly calculator.

Hourly Billing Invoice Template

Gross Pay And Net Pay What S The Difference Paycheckcity

Earning Calculating Your Pay The Disney College Program Life

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Earning Calculating Your Pay The Disney College Program Life

How To Read Your Pay Stub Paycheckcity

The Best Hourly Rate Calculators Determine Your Hourly Rate Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Tip Tax Calculator Primepay

Gross Pay And Net Pay What S The Difference Paycheckcity

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

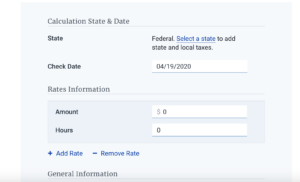

Calculate Your Paycheck With Paycheck Calculators And Withholding Calculators Paycheckcity

Calculate Your Paycheck With Paycheck Calculators And Withholding Calculators Paycheckcity

9 Best Free Paycheck Calculator Online Amazon Seller News Today

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits